Valuing What Doesn’t Exist: Hypothetical Conditions in Real Estate Appraisals

In the appraisal world, “playing pretend” is shorthand for a very real part of valuation work: answering “what if?” questions using market data and professional standards.

Quick Overview

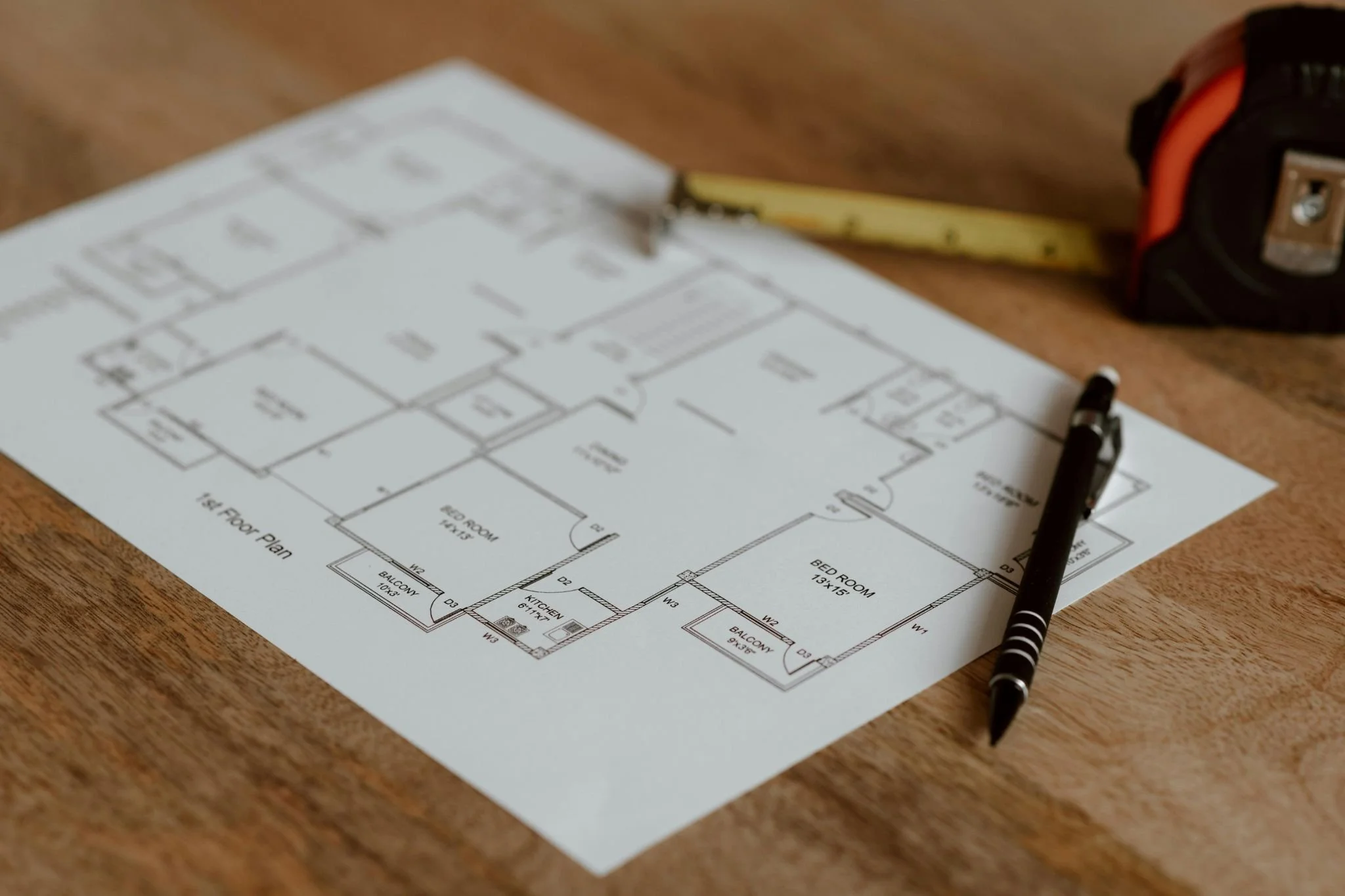

When you’re building a new home, planning a renovation, or evaluating a property that isn’t finished yet, value isn’t about what’s standing there today—it’s about what the market would recognize once the work is complete.

In appraisal terms, this is handled using a hypothetical condition. It’s a formal way for an appraiser to answer future-focused questions using today’s market data—based on approved plans, specifications, or clearly defined assumptions—rather than just the current physical state of the property.

This article pairs with a recent Substack post from Valiant’s owner, David Ziccardi, where he explores how hypothetical conditions show up in real appraisal work and why they’re often misunderstood. While David’s piece leans into the story and nuance behind these assignments, this companion piece focuses on how hypothetical conditions function inside an appraisal—and how they’re applied in real decision-making for homeowners, investors, lenders, and legal professionals.

What Is a Hypothetical Condition?

In appraisal terms, a hypothetical condition is an assumption the appraiser makes for the purpose of developing a credible opinion of value—even though that assumption is not true at the time of the appraisal.

Put simply, it allows the appraiser to answer a “what if” question that can’t be answered by looking at the property exactly as it exists today.

Common examples include:

What would this property be worth if it were fully built, based on approved plans?

What would it be worth after a planned renovation, assuming the work is completed as described?

What would it be worth if a condition that exists today did not exist, for legal or analytical purposes?

Hypothetical conditions are not guesses. They are a well-defined part of appraisal methodology and are permitted under USPAP (Uniform Standards of Professional Appraisal Practice) when they are reasonable, clearly disclosed, and appropriate for the appraisal’s intended use.

What “Playing Pretend” Really Means in Appraisal Work

The phrase “playing pretend” can sound casual or even childlike, but in appraisal work it’s anything but.

When an appraiser uses a hypothetical condition:

the assumption is clearly disclosed in the report

the reasoning behind it is explained

the valuation is supported with market data

and the condition is tied directly to the appraisal’s intended use

Hypothetical conditions are not used to inflate value or ignore market realities. They’re used when the client’s question can’t be responsibly answered by relying only on current conditions.

Why This Matters in Real-World Valuations

Hypothetical conditions show up more often than most people realize—not just in investor scenarios, but in:

construction financing

renovation planning

estate matters

divorce and other legal disputes

In some cases, a single property may even require multiple opinions of value, each tied to different assumptions or effective dates—depending on the question being asked.

The constant is that each assumption must be transparent, supportable, and appropriate for the situation at hand.

How Appraisers Use Hypothetical Conditions in Practice

As an appraiser, David’s role isn’t just to report past sales—it’s to interpret how the market would respond under clearly defined circumstances.

Hypothetical conditions make it possible to:

answer questions tied to timing, plans, and future decisions

separate emotion or speculation from market behavior

deliver valuations that are useful, defensible, and grounded in reality

They help bridge the gap between where a property is and where it’s going—which is often where the most consequential decisions live.

Why It’s Useful to You

If you’re a homeowner, hypothetical conditions can help you understand whether a renovation or build makes sense before committing significant time or money.

If you’re a lender or investor, they provide a structured way to evaluate risk, feasibility, and future value.

If you’re navigating a legal or family situation, they offer clarity when assumptions matter just as much as current conditions.

Bottom Line

Real estate decisions aren’t always about what exists today. Sometimes they hinge on what’s planned, what’s assumed, or what’s being evaluated for a specific purpose.

Hypothetical conditions are the tool that allows appraisers to answer those questions responsibly.

If you’re dealing with a property where timing, plans, or assumptions matter, we’re happy to talk through what kind of appraisal fits your situation.